In our rapidly digitizing world, the concern over secure transactions cannot be overstated. With the surge in online transactions, ensuring the security of each payment has become paramount. For those who are concerned about this transition, our services page offers insights into how we can assist, Let’s deep dive into the intricacies of payment security as we navigate 2023.

The Storied History of Secure Transactions

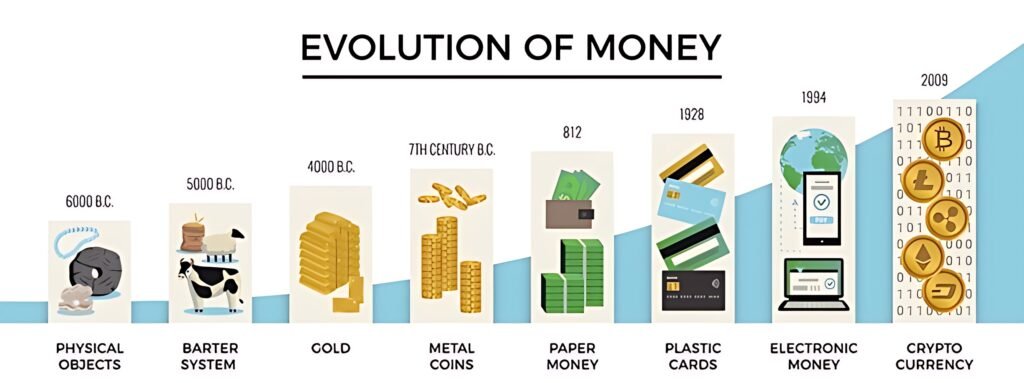

Historically, the evolution of transactions has been fascinating. From ancient barter systems to coins, from paper currency to credit cards, and now, to digital currencies and online payments. Every shift brought about its own security challenges.

The digital age, in particular, has been a game-changer. While it introduced unprecedented convenience, it also unveiled a multitude of vulnerabilities. From simple scams to sophisticated cyber-attacks, the digital realm has seen it all.

If you’re curious about how we’ve evolved our solutions over the years, you can visit our estimate page for a comprehensive breakdown.

Let’s look at how cyber threats have become more complex:

- Early 2000s: With the internet becoming mainstream, phishing emails and scams began to rise. These were primitive attempts to defraud individuals.

- 2010s: This era saw the rise of ransomware, where critical data was encrypted, and ransoms demanded. Big corporations and even cities found themselves at the mercy of such attacks.

- 2020s: Cyber threats have expanded to target the Internet of Things (IoT) devices, cryptocurrencies, and more. Machine-driven, automated attacks are now capable of crippling entire networks within minutes.

The Cyber Threat Landscape of 2023

This year, a range of threats loom large. Advanced Persistent Threats (APTs), state-sponsored attacks, deep fakes, and AI-driven attacks have become buzzwords, but they underline a grave reality.

Ransomware has evolved. Instead of merely locking out users, modern ransomware attacks threaten to leak confidential data. For businesses, this poses a dual threat – operational disruption and loss of reputation.

IoT remains a significant concern. From smart refrigerators to health wearables, the expanded web of interconnected devices offers multiple entry points for cybercriminals. If you’re concerned about safeguarding your IoT devices, our services cater to these modern challenges.

Emerging technologies aren’t immune either. Quantum computing, while promising to revolutionize industries, also holds the potential to break current encryption methods.

Pioneering Solutions for a Secure 2023

Security solutions have risen to the occasion:

- Advanced Threat Intelligence: This goes beyond conventional antivirus solutions. By leveraging AI, these tools can predict threats and secure systems proactively.

- Decentralized Systems: With distributed ledger technology, like blockchain, data isn’t stored centrally, making it inherently resistant to many cyber-attacks.

- Hardware Authenticators: Physical security keys are becoming popular for two-factor authentication, offering a tangible security layer.

- Zero Trust Models: Earlier, systems operated on a trust model. Now, with zero trust, every request is treated as though it originates from an open network, ensuring multi-layered verification.

To get a better idea of which solution fits your business needs, consider checking our estimate page.

Empowering the Digital Citizen

There’s an ongoing global effort to elevate the average internet user to a ‘digital citizen’ – someone well-versed in online etiquette and aware of cyber threats. Educational campaigns, cybersecurity drills, and awareness drives are becoming commonplace.

Maintaining Global Security Protocols

Unified, international security standards are more critical than ever. Protocols like the Payment Card Industry Data Security Standard (PCI DSS) ensure that businesses maintain a secure environment for any credit card transaction. For businesses looking to stay compliant with these international standards, our services offer comprehensive guidance.

Cross-border knowledge sharing, global cybersecurity forums, and international regulatory bodies work tirelessly behind the scenes, ensuring a cohesive defense strategy against cyber threats.

Consumer Trends Shaping Payment Security

Consumer habits and preferences play a pivotal role:

- Rise of Digital Wallets: With Google Pay, Apple Pay, and many other wallets, secure tokenization of payment info is being standardized.

- Preference for Biometrics: Consumers are more comfortable with biometric authentications, be it facial recognition or fingerprint scans.

- Demand for Transparency: Modern consumers demand to know how their data is being protected. They prefer businesses that uphold data integrity and transparency.

Conclusion

As 2023 unfolds, payment security remains a dynamic, evolving field. With the collective efforts of institutions, tech giants, governments, and consumers, the digital world is becoming more secure. Challenges will persist, but with awareness, innovation, and collaboration, secure transactions can be a reality for all. If you want to integrate a payment gateway, contact us.

Frequently asked questions

With the rapid digital transformation, the volume of online transactions has surged. This increase brings about a heightened risk of cyber threats, making the security of each payment essential. As technologies and threats evolve, staying updated with 2023's latest security measures becomes paramount.

Cyber threats have grown in complexity. From the early 2000s, when phishing emails were prevalent, to the 2010s marked by ransomware targeting corporations, to the 2020s where automated, machine-driven attacks can disrupt entire networks. The continuous evolution of these threats necessitates adaptive and forward-thinking security measures.

Some notable threats include Advanced Persistent Threats (APTs), state-sponsored attacks, AI-driven attacks, and evolved ransomware that threatens data leaks. The expansive IoT network also provides multiple entry points for cybercriminals, making it a significant concern.

Security solutions in 2023 employ Advanced Threat Intelligence powered by AI to predict and counteract threats. The rise of decentralized systems, like blockchain, offers inherent resistance to many cyber-attacks. Additionally, the adoption of hardware authenticators and zero-trust models provides more robust security layers.

Global security protocols, such as the Payment Card Industry Data Security Standard (PCI DSS), are crucial in maintaining a uniform security standard across borders. They ensure businesses maintain a secure environment for transactions. Cross-border collaborations and international regulatory bodies also play a vital role in forming a united front against cyber threats.

Consumer preferences significantly shape the payment security landscape. The rise of digital wallets standardizes the secure tokenization of payment information. Moreover, there's a growing preference for biometric authentications, such as facial recognition or fingerprint scans. Modern consumers also demand transparency, favoring businesses that uphold data integrity.